Tax Notices

Tax agencies send notices to employers about their business taxes, such as withholding, unemployment, or other state-specific obligations. This topic explains common reasons you may receive a tax notice, how to read it, and how to share it with us for review and resolution.

Tax agencies, such as the IRS or state jurisdictions, use notices to communicate with employers about their business regarding unemployment, withholding, and other state-specific taxes. All tax notices are sent to employers directly and are never sent directly to Pavillio as you payroll provider.

Below is a list of common tax filing errors that result in an employer receiving a tax notice, as well as common tax notice types and how to resolve them.

If you receive a tax notice via mail or email, share the notice with us by

Below is a list of common tax filing errors that may result in either a rejected filing or tax notice being received:

-

Duplicate filing: Another tax return is already on file. This usually happens when a previous payroll provider files on behalf of the employer.

-

Invalid account number / Applied For: Review any correspondence you've received from the tax agency, log into your online account with the tax agency, or call the tax agency directly.

-

Invalid SSN: Update the employee's SSN.

-

Account closed: This happens when someone hasn't had payroll for several quarters. Call the tax agency and let them know you need to activate your account.

-

No access: The enrollment process has not been completed. Follow our provided directions to complete your enrollment.

-

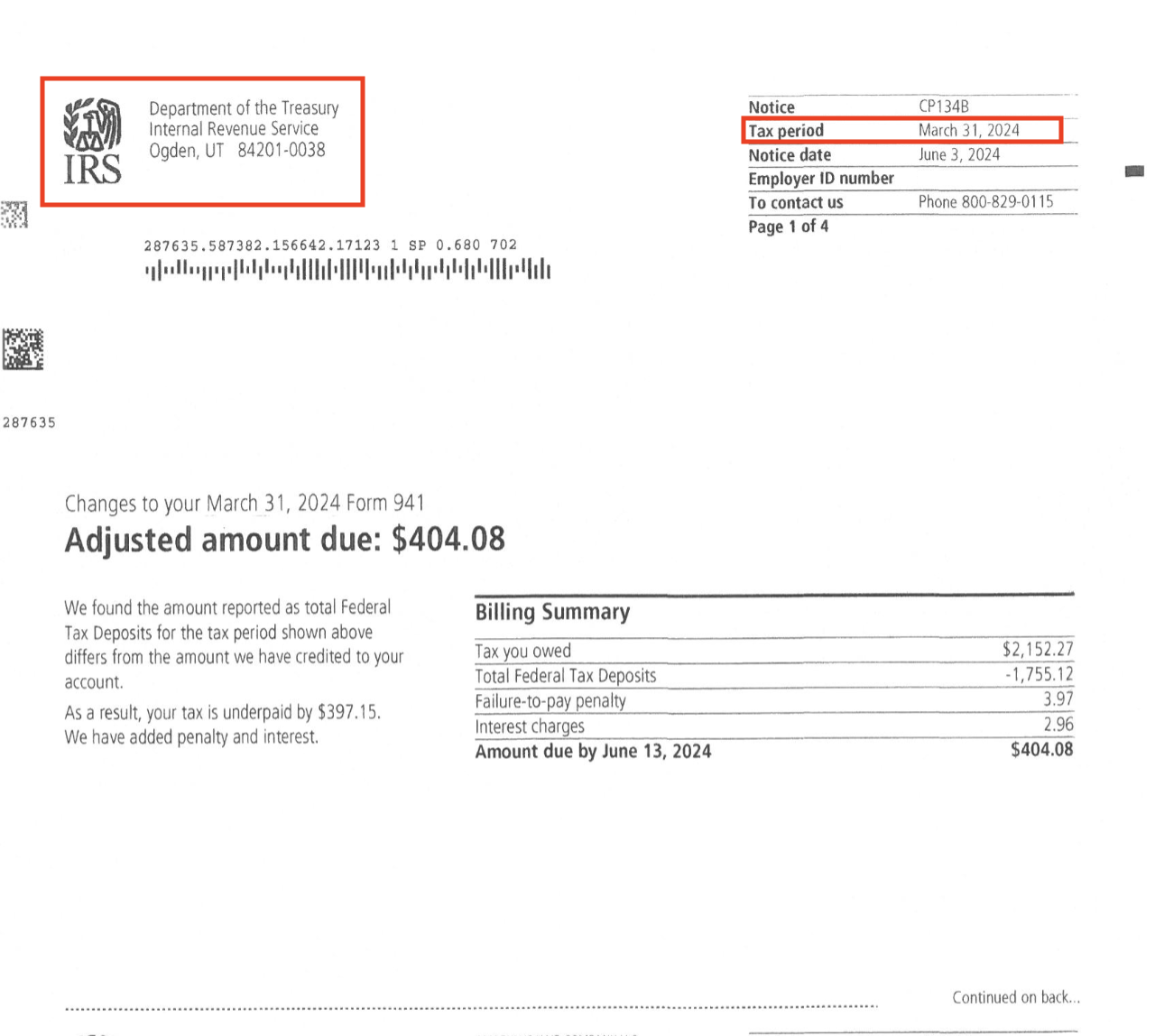

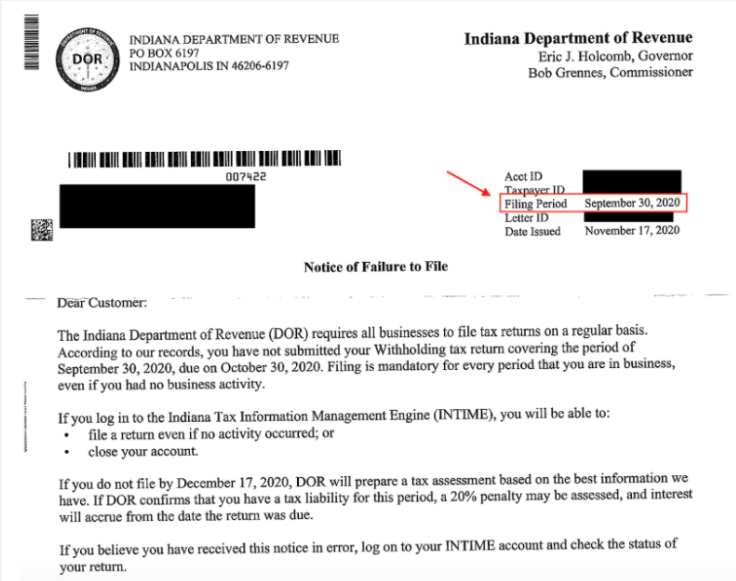

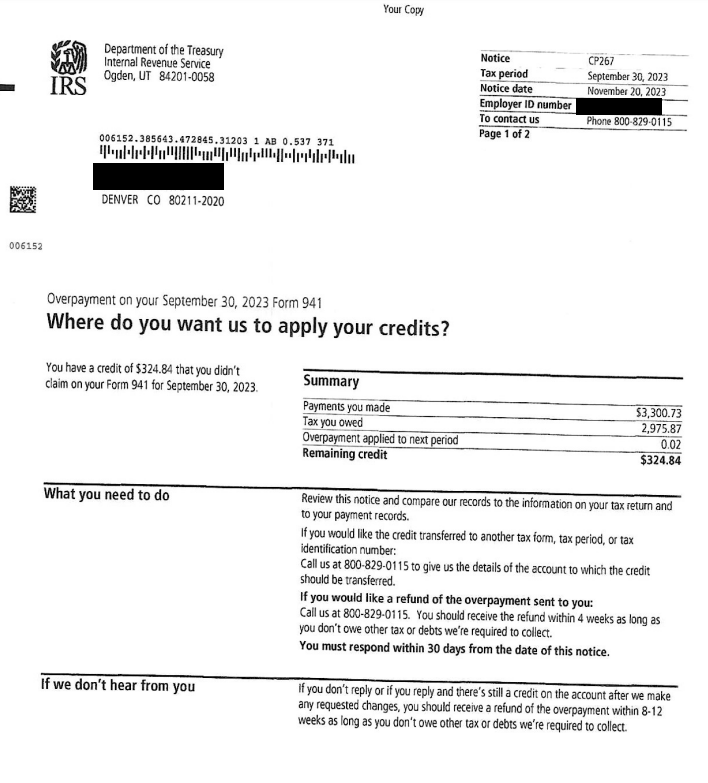

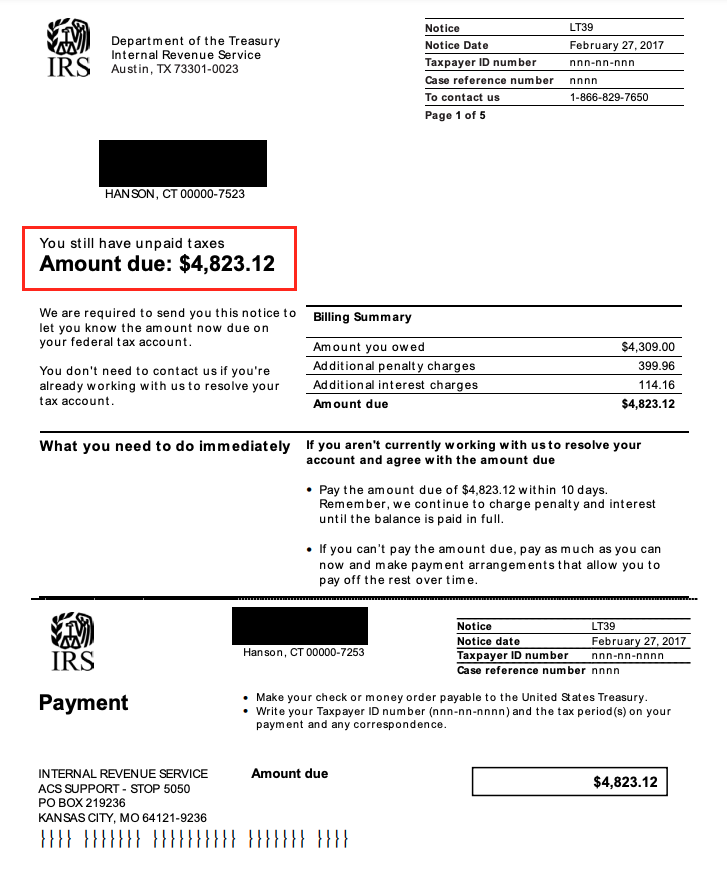

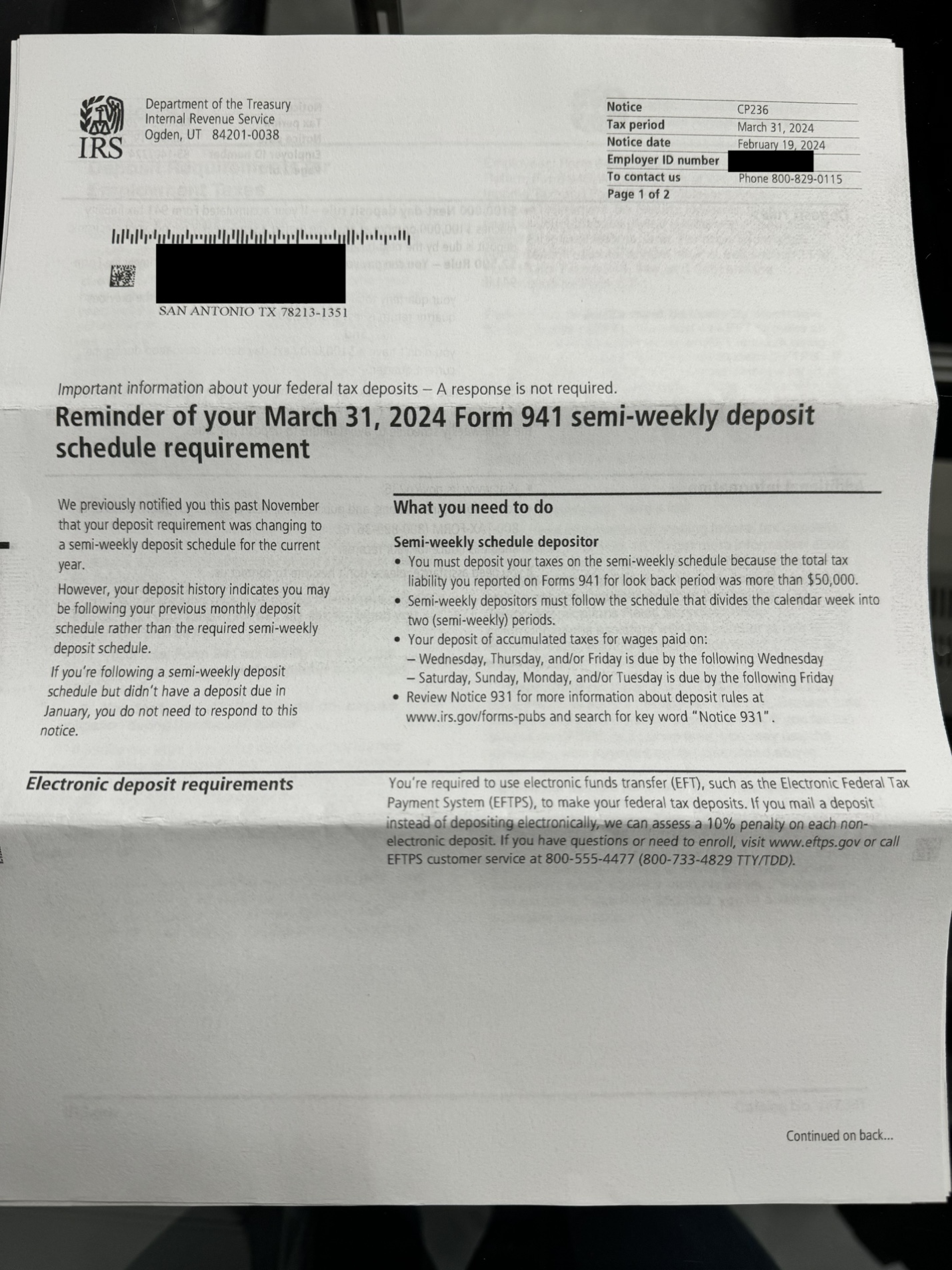

Who sent the tax notice? At the top of the notice, is an agency name (i.e. IRS or Indiana Department of Revenue).

-

What is the notice filing period? The filing or notice period identifies the relevant quarter/month and year.

-

If your first payroll check date within our system is after the notice period, we will assist in reviewing/handling the notice.

-

If your first payroll check date within our system is before the notice period, you will need to contact your previous payroll provider or the notice agency directly to assist with reviewing/handling the notice.

-

-

Does the employer data on the notice match your payroll settings? Review the employer profile to confirm that all data shown on the notice matches what is currently within payroll settings. If any of the following information is missing or inaccurate in the payroll settings, this may have been what resulted in the tax notice being received:

-

Business legal name

-

Account ID/FEIN

-

Tax rate(s)

-

Business filing address

-

Deposit schedule

-

Below are a few reasons why a tax agency may send a notice of an overpayment on your account:

-

Duplicate payments/filing: You changed payroll providers and both the old and new providers submitted a payment/filing on your behalf. Duplicate filings can also be made if an employer and the current payroll provider both submit a payment/filing.

-

Penalties forgiven (abated): You may see an applied credit or overpayment if the agency removed a previously assessed penalty.

-

General adjustments: A credit may be applied if there are updates to wage or tax information.

-

General filing errors: If you change payroll providers in the middle of a tax period and inaccurate tax data is migrated to the new provider, filings may be underreported. As payrolls are processed, this would reflect an overpayment on the account.

Below are a few reasons why a tax agency may send you a notice of a balance due on your account:

-

Missing Payment(s): Payment was not properly processed by the agency due to potential data mismatches (i.e. tax ID number error) or delays. See the Common Tax Filings Errors section above.

-

Unauthorized payment: If a company has not provided necessary authorization to their payroll provider, it is possible that the payment was not processed. This could also be a partial payment due in various cases, such as when switching payroll providers.

-

Late payment: A notice for late payment could be sent out if a payment is not received by the agency by the appropriate due date. This could result in penalties and interest being assessed as well.

-

Missing filing: If a filing is not received for a tax period, various agencies may issue a notice displaying an estimate of the wages and taxes due. In order to resolve this, the filing first needs completed in order to determine the balance that is due on the account.

-

General adjustments: If a correction is done to prior filings, there may be an additional amount due if there are changes in the total tax liability amount.

-

General filing errors: Over-reported amounts due to changing providers, incorrect identification numbers used, lack of employer providing authorization to payroll providers, or tax rate changes could all be potential reasons for a balance remaining on the account and penalties being assessed.

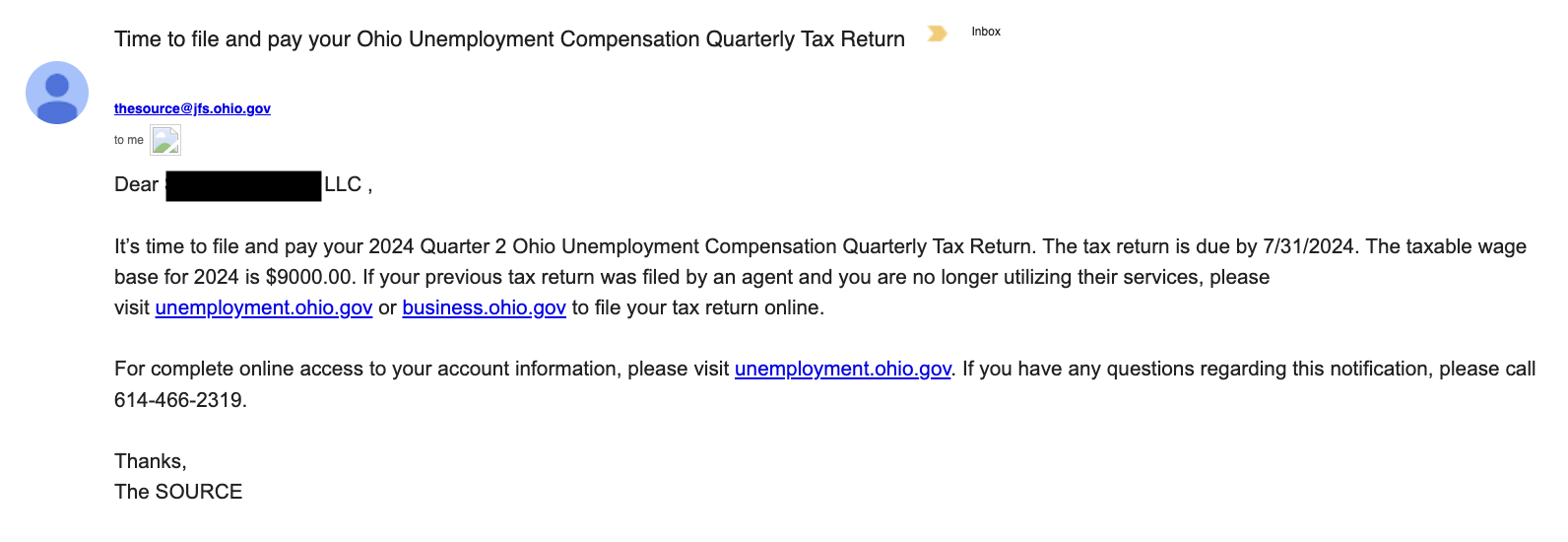

It is common for an agency to send a reminder notice via mail or email when the current quarter is soon coming to an end. These notices do not need to be sent to us for review nor does any action need to be taken on your end. These notices often include a blank filing form as well. As your payroll provider, we handle the upcoming payroll tax filings for you and already have any physical forms required.